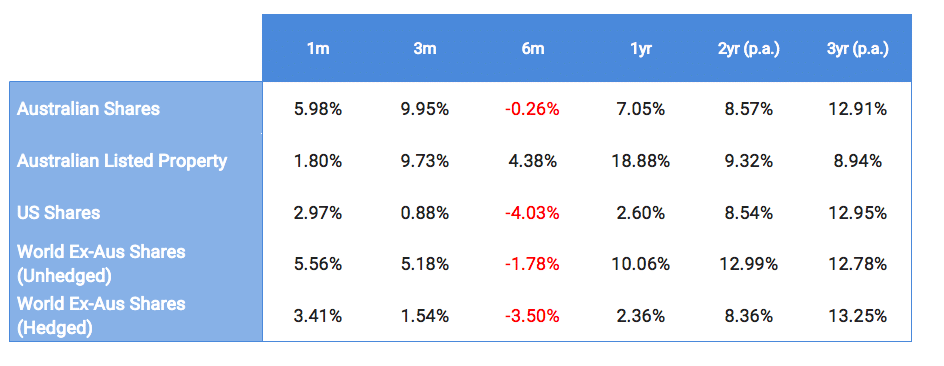

Equities continued their stellar run from the lows of early January, with Australian shares returning just shy of 6% for the month and 10.1% so far in 2019. February was primarily led by energy (+7.9%), IT (+7.6%) and financials (+9.1%) which was the real driver of returns. In price terms the market has now fully recovered since the start of the sell-off in October 2018, as can be seen below:

You’d be forgiven for looking at these returns and thinking that all is rosy with financial markets, however, in recent days talk of doom and gloom in the Australian economy has taken a step up a notch amid fears of looming recession. Economists are falling over themselves in predicting further interest rate cuts for the following reasons:

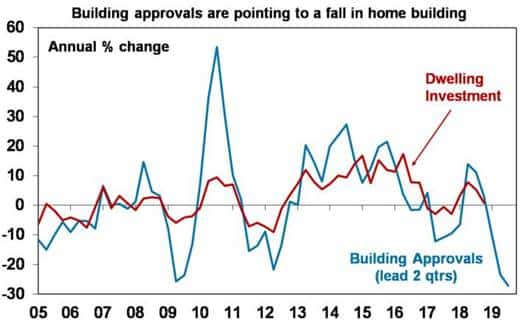

- Economic growth has slowed and is likely to remain weak as the housing downturn continues with continued falls in Sydney & Melbourne property prices predicted throughout 2019. With reference to the chart below, we can see that building approvals have fallen sharply.

- You may have heard that, based on fourth quarter GDP, we have entered into a “per capita recession”, essentially meaning that GDP growth is slower than population growth.

- Weak growth should drive higher unemployment and further dampen wages growth and inflation, which is already non-existent.

- East coast droughts are continuing, putting a significant laggard on agricultural production.

The general consensus is now that the RBA will cut rates at least once this year, with a growing chorus (such as UBS) predicting two cuts. We see it as being feasible that cuts of up to 1% could take place over the next 18 months to 2 years, given that, it is likely that the banks will only pass half of this onto consumers (more great press for them!). This bodes well for the listed property sector, which has delivered an extraordinary year – returning 18.9%! This would also see fixed rate bonds outperform, and would not be good news for those holding cash and term deposits, particularly if relying on the income they produce.

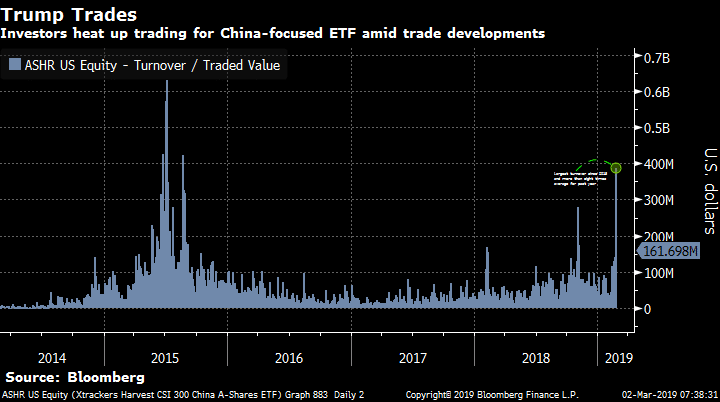

Turning to our largest trading partner now and the economic data hasn’t been too flash. Whilst GDP growth is expected to come in at 6%, the Chinese government did make note of a number of difficulties, which indicate to us a significant slowing of future growth. They need an end to the trade war with the US, or at least a ceasefire. We also know that Trump wants to make a deal (having failed with North Korea) and the Fox News breaking news headline has already been written. Global trade volume has taken quite a hit in recent months but we’re confident that the world’s two largest economies will come to a short-term conclusion. This is seeing funds pour into Chinese based equity investments, as can be seen in the chart below.

Also worth noting is that we have an early Federal Budget this year, which is due to be handed down on April 2nd. With the election campaigns expecting to kick off not long after this, it should hopefully present some interesting and beneficial changes, not that a lot of us are holding our breath!