Happy New Year to you all! Welcome to our December market update.

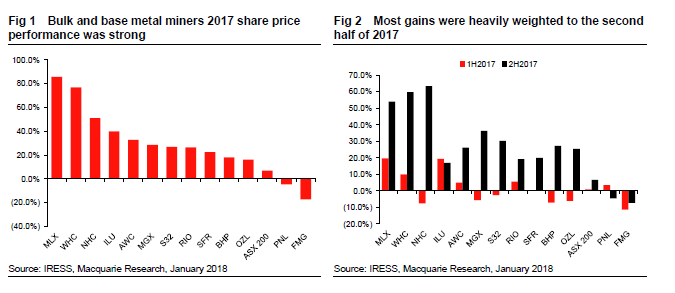

2018 closed out a strong year, with the Australian market up around 12%. Resources were the biggest contributor, being up over 25%, with Health Care and IT also returning around these levels, however, make up a much smaller portion of our market. Below shows how well the resource companies have done, particularly in the second half of the year:

This has created a positive flow on into mining service companies, generally providing a tailwind for the WA economy. The big question is of course, can this continue for resources and the market in general? Our view is absolutely it can, with the caveat being a higher risk of a pullback or market correction given the sharp positive run over the past 6 months. We see the resources sector as having the greatest potential upside for 2018, with solid global growth supporting higher commodity prices.

It is inevitable after a reasonably strong period, particularly in the US which has been in a strong bull market for quite a while, that the outlook is becoming tainted by ‘click bait’ headlines citing ‘the one thing that could bring markets crashing down’ or the ‘bursting of the equity bubble’. The simple fundamental facts at the moment are:

- World economies are firing on all cylinders with simultaneous economic growth not seen in over a decade;

- Equity markets, with the exception of the US, are not overvalued;

- Corporate earnings growth is strong;

- Favourable central bank policies remain in place.

The major risk factor we see heading into 2018 is the return of inflation above and beyond what is expected by the US Fed (the key indicator to watch is US wage inflation). This is a very real possibility and has the potential to build through 2018 and may well be a problem heading into 2019. This creates a problem because the US Fed would be forced into raising interest rates at a faster rate than the market expects. As we know, markets do not like uncertainty and should this be the case, we would expect a significant repricing of all assets, equities, bonds and real assets. In fact, famous bond investor Bill Gross from Janus Henderson has already stated that US bonds have entered into a bear market (https://www.cnbc.com/2018/01/10/bond-guru-bill-gross-signals-end-of-bull-era-for-treasury-markets.html).

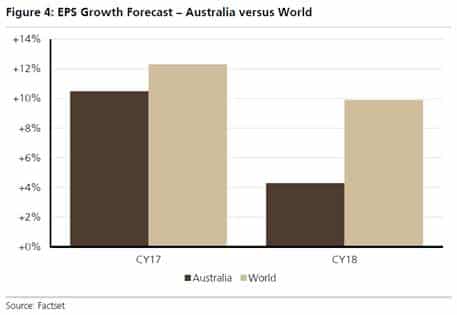

All up, we expect the bull market to extend through early 2018 for US, Europe and Asian equity markets, driven by above-trend earnings growth. In this regard, we continue to see Australia as a laggard however it is more than capable of producing another trend-like return (8-10%). Underperformance in 2017 is likely to present a headwind for relative performance in 2018.

Taking a step back from equities for now, I’ll touch on some other market developments for the year ahead. In the fixed interest space we expect a continued rise in bond yields (which is nearly always coupled with capital losses). Therefore, we expect to see low returns from bonds in 2018. Cash and bank deposits are also likely to continue to provide poor returns, with term deposit rates running around 2.2%.

In property, Sydney and Melbourne’s housing boom continues to deflate, with expected prices falls of around 5%. Whilst Perth and Darwin appear to have bottomed out, Adelaide and Brisbane should see moderate gains and Hobart continue its strong run. Locally, finance approvals for owner-occupied housing and building approvals have increased for 5 consecutive months. However, both coming off low levels and whilst the direction is positive, the magnitude of increase is still relatively small.

I’m not sure what to make of the Australian dollar. For years now the outlook has been that of a sharp decline and 2018 is no different with consensus forecasts of about US$0.70 (if you can recall, consensus forecasts for 2017 were US$0.65). Logically speaking this makes sense, as the gap between the US Federal Funds rate and the RBA cash rate goes negative, a phenomenon that has been absent for quite some time. Under such a scenario we would expect a large capital outflow from the low-interest environment (Australia) into the higher interest environment (US) in order to capitalise on the higher interest rates, which in turn should put downward pressure on the AUD. That said, the Australian dollar remains resilient and solid commodity prices in 2018 should provide support for the Aussie battler.

That is all for this month, all the best for 2018!