Knight 2021 Tax Planning Guide – Businesses

Businesses Ensure any eligible bad debts are written off correctly through your accounting software or the decision to write them off is documented correctly in

Businesses Ensure any eligible bad debts are written off correctly through your accounting software or the decision to write them off is documented correctly in

Summary – 11 May 2021 This year’s budget has been described as a spending budget, not a taxing budget. This is not surprising, given the

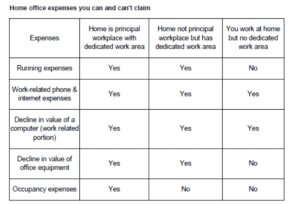

Did you find working from home during COVID-19 lockdown to be a success? Are you considering giving up your leased commercial business premises to instead

The federal government has now officially announced part two of its COVID-19 stimulus plan to give further support to affected businesses, workers and the broader

Work Related Car Expense Claims The Australian Tax Office has announced that it would be closely examining claims for work-related car expenses as part of

Financial year end is upon us so it’s a natural time to direct our thinking to the future. But how can we do this when

© KNIGHT Group Pty Ltd, 2024. All rights reserved

PORTAL LOGINS | SITEMAP | PRIVACY POLICY | PUBLIC COMPLAINTS POLICY

Website by 3BY2