Summary – 11 May 2021

This year’s budget has been described as a spending budget, not a taxing budget. This is not surprising, given the likely upcoming election and the better-than-expected outcomes following last year’s stimulus packages. We welcome this approach – it provides certainty to businesses and individuals to continue to play their part in the country’s economic recovery. The message to businesses is to continue to invest in your business and pay little or no tax. The message to individuals is that many of you have another $1,000 in your pockets this year!

We summarise the key measures below. Please give us a call if you would like to discuss how these measures will apply to you or your business.

For Individuals

Many will welcome the extension of the Low and Middle Income Offset for another year, which will see up to $1,080 paid back to individuals with earnings up to $126,000, when they lodge their FY2022 tax returns. There have also been some changes proposed to superannuation, including more flexibility for older Australians making contributions to their super and mandatory super guarantee contributions for more part-time and casual workers.

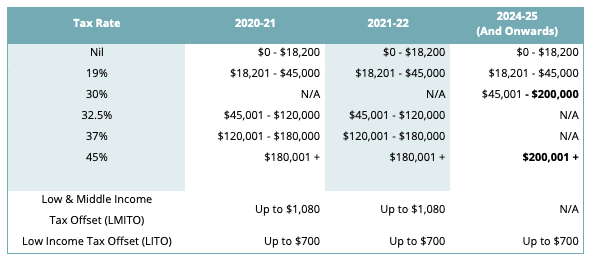

Income Tax Rates

As expected, the Government has announced that the low middle-income tax offset (LMITO) will be extended for the 2021-22 income year. Low and middle-income earners will receive tax relief of up to $1,080, the same as in FY2021. Those earning between $48,000 and $90,000 a year will receive the maximum offset. It is phased out for those earning over $90,000 and is not available for those earning over $126,000. Previously legislated reductions in tax for higher earners from 2024-25 remain unchanged.

Note: Rates above exclude the 2% Medicare Levy

The current non-deductibility of the first $250 of eligible self-education expenses will be removed

from the financial year commencing after Royal Assent. We expect this to be in place for the financial year commencing 1 July 2021.

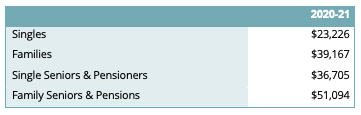

There are minor increases to the Medicare Levy thresholds, to ensure that low earning individuals and families continue to be exempt from the Medicare levy. From 1 July 2020 the thresholds are as follows:

For each dependent child or student, the family income thresholds increase by a further $3,597.

Superannuation and Retirement

Three key changes are included in the Budget to allow more Australians to grow their superannuation balances, all commencing from 1 July 2022:

- The work test is abolished for those aged 67 to 74 for non-concessional and salary sacrifice contributions. This means that individuals can continue to make certain super contributions up to the age of 74, even if they are not working at all. Access to concessional personal deductible contributions for individuals aged 67 to 74 will still be subject to meeting the work test.

- The downsizer contributions scheme is extended to individuals aged 60 (the minimum age has been reduced from 65), meaning an individual who sells their home, once they have lived in that home for at least the last 10 years, can make an extraordinary contribution to super of up to $300,000 per person. These contributions are allowed even if contribution caps and/or transfer balance caps have already been reached.

- The $450 per month minimum threshold for Super Guarantee contributions has been removed, meaning more part-time and casual workers will receive super contributions from their employers.

Tax Residency Rules

The Government has announced it will update the tests for residency of individuals. It is broadly thought that these changes will result in more individuals being Australian residents for tax purposes.

The proposed changes will adopt a set of rules that start with a 2-step process.

- Step One – the 183-day test that currently exists; and

- Step Two – testing whether they are a continuing resident or commencing residency (secondary rules).

Step Two requires any two of four objective factors to be satisfied, for an individual to commence to be resident. These four factors are:

(a) The right to reside permanently in Australia (including citizenship and permanent residency);

(b) Australian accommodation;

(c) Australian family; and

(d) Australian economic connections.

We expect these new rules to be in place for the financial year commencing 1 July 2021.

For Businesses

Another year for Temporary Full Expensing and Company Loss Carry Back! Both measures were welcome components of stimulus contained in last year’s budget, so it is not a surprise that the Government has extended both to the 30th June, 2023. Particularly when working together, these measures have the potential to generate huge cash flow benefits for businesses. The Loan Guarantee Scheme is also extended, and more targeted to businesses with needs arising from the impacts of the pandemic.

Temporary Full Expensing of Assets

This popular measure is extended for another year until 30 June 2023. This allows eligible businesses to bring forward the full depreciation tax deduction for purchased assets in the year of purchase rather than spreading that tax deduction over a number of future years. It is available for businesses with an aggregated annual turnover of less than $5 billion on all assets and for businesses qualifying as small and medium-sized businesses also on second-hand assets.

Company Loss Carry-Back

Again, this measure is extended for a further year to 30 June 2023. Losses incurred up until 30 June 2023, by companies with a turnover of under $5bn, can be carried back as far to the year ended 30 June 2019. The loss relief is capped to the extent of existing taxed profits and franking credits.

SME Recovery Loans

The Budget confirms the Government’s earlier announcement that the SME Recovery Loan Scheme will follow on from the previous Coronavirus SME Guarantee Scheme. Given the lower than expected uptake of the first two phases of this scheme, the proposed changes to broaden and extend the scheme, are welcome. The eligibility requirements effectively target the scheme at only those businesses, which had not largely recovered from the impact of the pandemic by December 2020.

Phase 1 of the Coronavirus SME Guarantee Scheme only permitted loans of up to $250,000 over a 3-year term, with the Government guaranteeing half of the loan. Phase 2 extended the maximum loan amount to $1 million over a 10-year term.

The proposed SME Recovery Loan Scheme will allow loans up to $5 million for a maximum term of 10 years and a maximum interest rate of 7.5%. The scheme is backed by a Government guarantee of 80% of the loan.

Eligible businesses are those with turnovers of up to $250 million who either received JobKeeper from 4 January 2021 or businesses that were impacted by the NSW floods during March 2021.

Employee Share Schemes

Perhaps in the hope of enticing more businesses to offer ESS interests to their employees, the Budget proposes that an employee would be allowed to defer the taxing point of a benefit received under an ESS, even after they leave the employment.

This change will result in tax being deferred until the earliest of the remaining taxing points:

- in the case of shares, when there is no risk of forfeiture and no restrictions on disposal;

- in the case of options, when the employee exercises the option and there is no risk of forfeiting the resulting share and no restrictions on disposal; and

- the maximum period of deferral of 15 years.

ATO Debt Recovery Actions

Small businesses, (aggregated turnover of less than $10 million), will be able to apply to the Small Business Tax Division (SBTD) of the Administrative Appeals Tribunal (AAT) to pause or modify ATO debt recovery actions where the debt is being disputed within the AAT.

Currently, businesses must apply through the courts to pause or modify ATO debt recovery actions, which can be costly and time-consuming. These changes will apply for proceedings commenced on or after the date of Royal Assent of the legislation, which we expect to be soon.

Digital Economy and Patents

Among the investment commitments to target digital and biotechnology sectors, the Budget proposes the introduction of the following tax measures:

- The Government will introduce a Digital Games Tax Offset, a 30% refundable tax offset, for eligible businesses that spend a minimum of $500,000 on qualifying Australian games expenditure. Games with gambling elements or that cannot obtain a classification rating will be ineligible.

- The Government will amend the income tax law to allow taxpayers to self-assess the tax-effective lives of eligible intangible depreciating assets, such as patents, registered designs, copyrights and in-house software, rather than being required to use the effective life as currently prescribed by statute. Taxpayers are eligible to bring deductions forward if they self-assess the assets as having a shorter effective life to the statutory effective life. This will apply to assets acquired from 1 July 2023, following the completion of the temporary full expensing regime. Taxpayers will continue to have the option of applying the existing statutory effective life to depreciate these assets.

- From 1 July 2022, the Government has proposed a special reduced tax rate of 17% for companies deriving income from eligible Australian patents in the medical and biotechnology sectors (compared to either 30% or 25% currently). Only patents applied for after the Budget announcement will be eligible.