Australian Federal Budget – 2022/23

Federal Budget 2022/23

It was no surprise that this was a targeted spending budget with minimal changes to taxation and superannuation, given the upcoming Federal Election. For SMEs, two new “Boost” incentives have been announced, to encourage investment in developing technological capabilities, cyber protection and employee training and development. Although nothing close to the benefits provided by the COVID-era Cashflow Boost, these new incentives are still welcome and timely.

For Individuals

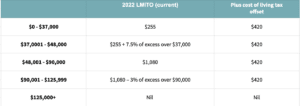

Personal Income Tax – Low and Middle Income Tax Offset

This tax-offset, which was introduced a few years ago as a temporary measure, will not be continued into FY2023. The parting gift is that the amount is increased from $1,080 to $1,500 for FY2022 to incorporate a once-off $420 ‘cost of living tax-offset’.

Similarly to previous years, this offset will be paid from 1 July 2022 when Australians submit their tax returns for the 2022 income year, where individuals are eligible to receive it as a cash refund.

Medicare Levy

Marginal increases to the Medicare levy low-income thresholds were included in the Budget.

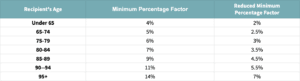

Super Pension Drawdowns

The Government will extend the 50% reduction of superannuation minimum drawdown requirements for account-based pensions (‘ABPs’) and similar products for a further year to 30 June 2023.

Other Non-Tax or Super Related Measures

The two new measures grabbing most of the news headlines are:

- One-off Cost of Living Payment of $250 (tax exempt) to eligible welfare recipients and concession cardholders; and

- Temporary reduction in fuels excise of $0.22 per litre, commencing 30th March, for 6 months.

For Businesses

Small and Medium Sized Business Skills and Training Boost

Business Eligibility

- Aggregated annual turnover of less than $50 million.

Expenditure Criteria

- Incurred from 7:30pm (AEDT) on 29 March 2022 (i.e., Budget night) until 30 June 2024.

- External training courses provided to their employees in Australia or online and delivered by entities registered in Australia.

- Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

Boost Available

- An additional tax deduction of 20% of the expenditure incurred

- For example a business operated by a company incurs $150,000 in eligible training costs. It is already allowed to claim a tax deduction for this $150,000 as a normal business expense. This boost allows an additional tax deduction of $30,000 ($150,000 x 20%).

- This results in a tax saving of $7,500 ($30,000 at the company’s income tax rate of 25%).

How to Claim

- For eligible expenditure incurred by 30 June 2022, the boost will be claimed in tax returns for the following income year.

- For eligible expenditure incurred between 1 July 2022 and 30 June 2024, the boost will be claimed in the income year in which the expenditure is incurred.

Small Business Technology Investment Boost

Business Eligibility

- Aggregated annual turnover of less than $50 million

Expenditure Criteria

- Incurred from 7:30pm (AEDT) on 29 March 2022 (i.e., Budget night) until 30 June 2023.

- Business expenses and depreciating assets that support the business’ digital adoption (such as portable payment devices, cyber security systems or subscriptions to cloud-based services).

Boost Available

- An additional tax deduction of 20% of the expenditure incurred, up to the annual cap of $100,000, equating to a maximum additional tax deduction of $20,000 per eligible tax year.

How to Claim

- For eligible expenditure incurred by 30 June 2022, the boost will be claimed in tax returns for the following income year.

- For eligible expenditure incurred between 1 July 2022 and 30 June 2024, the boost will be claimed in the income year in which the expenditure is incurred.

Data Sharing – ATO and State Revenue

Funding was announced to enhance the information sharing regime that is already in place. The aim is that payroll tax returns (State Revenue) will be prefilled with Single Touch Payroll data (ATO). Given the ever increasing data available to the various authorities, this is a timely reminder for businesses to consider if they have or should have audit insurance cover from a specialist provider.

Employee Share Schemes

The scheme is being expanded so that participants will now be able to invest in unlisted companies, up to the following amounts (thereby allowing employers to access simplified disclosure requirements and exemptions from licensing):

- $30,000 per participant per year (which is an increase from $5,000), accruable for unexercised options for up to five years, plus 70% of dividend and cash bonuses; or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

The Government will also remove some other regulatory requirements.

PAYG Instalments and Taxable Payment Reporting

Streamlining of current year instalments to align with current financial performance and the option to change taxable payments reporting cycle to coincide with BAS cycle.

Subject to the capacity of software providers, it is anticipated that systems for both measures will be in place by 31 December 2023, to commence on 1 January 2024.

Australian Apprenticeships Incentives Scheme

For Employers

- From 1 July 2022 employers in “priority occupations” will receive a 10% wage subsidy for first and second-year apprentices (up to $1,500 per quarter) and 5% for third years (up to $750 per quarter). The total cap for 3 years is $15,000 per eligible apprentice.

- Employers in regional areas will receive an additional 5 per cent wage subsidy for each of the three years of an apprentice’s training.

- Hiring incentive of $3,500 (paid over 2 equal 6 monthly instalments) for employers of Australian Apprentices not in a “priority occupation”.

- This marks a change from the previous program (Boosting Australian Apprenticeships or BAC), with the new regime targeting successful completion of apprenticeships.

- The BAC remains available for employers taking on new or recommencing apprentices or trainees until 30 June 2022 (a 3 month extension from the previous cut-off of 31 March 2022). Under the BAC scheme, half of an eligible apprentice’s wages in their first year of employment is subsidised, up to $7,000 a quarter.

- Apprentices already in place at 30 June 2022 will be supported under the new scheme from 1 July 2022.

These “priority occupations” will be determined by a new Australian Apprenticeships Priority List, based on findings from the National Skills Commission, accounting for both current and expected future demand. This new list will be updated annually.

For Apprentices

- From 1 July 2022 “priority occupation” apprentices will be eligible for a training support payment of $1,250 every six months for two years, up to a total of $5,000.

- Australian Apprentice Support Loans of up to $21,779 and Living Away from Home Allowances of continue to be available, subject to conditions.

Other Business Measures

The Government has announced additional funding over three years to support small and medium-sized businesses, including for:

- Payment Times Reporting Portal and Register to improve efficiency and reporting;

- Australian Small Business and Family Enterprise Ombudsman to work with service providers to enhance small business financial capability;

- New Access for Small Business Owners program delivered by Beyond Blue to continue to provide free, accessible, and tailored mental health support to small business owners; and

- Small Business Debt Helpline program operated by Financial Counselling Australia to continue to provide financial counselling to small businesses facing financial issues.

No extension of:

- Temporary Full Expensing of Assets; and

- Company Tax loss ‘Carry back’.

Both regimes will end on 30 June 2023.