HELP Debt Increases from 1 June 2023 – What steps can you take?

What is indexation and what does it mean for your HELP loan?

HELP is a Government loan scheme that assists Australian university students to pay for certain education fees. Repayment on the loan commences once the student reaches a certain threshold of earnings ($48,361 in FY2023).

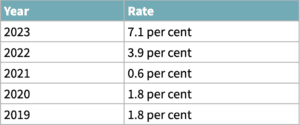

The loans are interest free but are subject to indexation, in line with the inflation rate.

What steps can you take to reduce the impact of indexation?

Every family is different, however, within some families HELP debts (formerly HECS) for family members are often paid by parents or grandparents or by family investment entities, directly or through the tax system.

Due to the changes to the indexation of HELP debts outlined below, if you intended to pay some or all of the current HELP debt for yourself or a family member in the next couple of years, you could benefit by making that payment before 30 May 2023.

After 30 May 2023, all HELP balances will be increased by 7.1%. Payments can be made via the tax system (if added to income tax liabilities) or directly under the voluntary method.

For example, your investment trust may have made a distribution in the tax year ended 30 June 2022 to your child who is studying at university and has a HELP debt. If the student’s taxable income is above the HELP repayment threshold, a HELP debt repayment will be required as part of the student’s FY2022 income tax liability.

Under the tax system, that income tax liability may not be due and payable until 5th June. However, if you or the student pay it earlier, on say 25th May, you would protect that amount of the HELP debt from the 7.1% increase on 1 June.

BPAY can take a few days to process so you should allow 3 business days for clearance in advance of 30th May.

If you would like to understand how this change impacts you and your family please feel free to give us a call.